Depreciation Expense & Straight-Line Method w Example & Journal Entries

Content

Three years have passed since the purchase and the company wants to calculate the accumulated depreciation for each year. The years of use in the accumulated depreciation formula represent the total expected lifespan of an asset. The IRS provides data tables that can show you the expected lifetime value of a particular asset.

If the amount received is greater than the book value, a gain will be recorded. Businesses decide how to make investments and allocate funds based on accumulated depreciation since an asset’s accumulated depreciation affects its value. Assets may lose value over time as a result of technological https://kelleysbookkeeping.com/ updates, use and wear or other deteriorating factors. The company will rather change the amount of accumulated depreciation recognized annually. Seven years have passed since the purchase, and the company is calculating the accumulated depreciation using the straight-line method of depreciation.

Depreciation on Assets Purchased During the Year FAQs

Useful life can be expressed in years, months, working hours, or units produced. Depreciation is defined as the expensing of the cost of an asset involved in producing revenues throughout its useful life. The IRS requires businesses to depreciate specific assets using the Modified Accelerated Cost Recovery System . If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

Many companies rely on capital assets such as buildings, vehicles, equipment, and machinery as part of their operations. In accordance with accounting rules, companies must depreciate these assets over their useful lives. As a result, companies must How To Calculate Beginning Year Accumulated Depreciation recognize accumulated depreciation, the sum of depreciation expense recognized over the life of an asset. Accumulated depreciation is reported on the balance sheet as a contra asset that reduces the net book value of the capital asset section.

Beginning Year Accumulated Depreciation

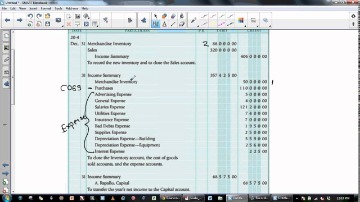

In straight-line depreciation, an equal portion of an asset’s cost is depreciated in each period of its life. Depreciation expense represents the reduction in value of an asset over its useful life. Multiple methods of accounting for depreciation exist, but the straight-line method is the most commonly used. This article covered the different methods used to calculate depreciation expense, including a detailed example of how to account for a fixed asset with straight-line depreciation expense.

How do you calculate beginning accumulated depreciation?

- Subtract the asset's salvage value from its total cost to determine what is left to be depreciated.

- Divide this value by the number of years of the asset's lifespan.

- Divide this figure by 12 to learn the monthly depreciation.